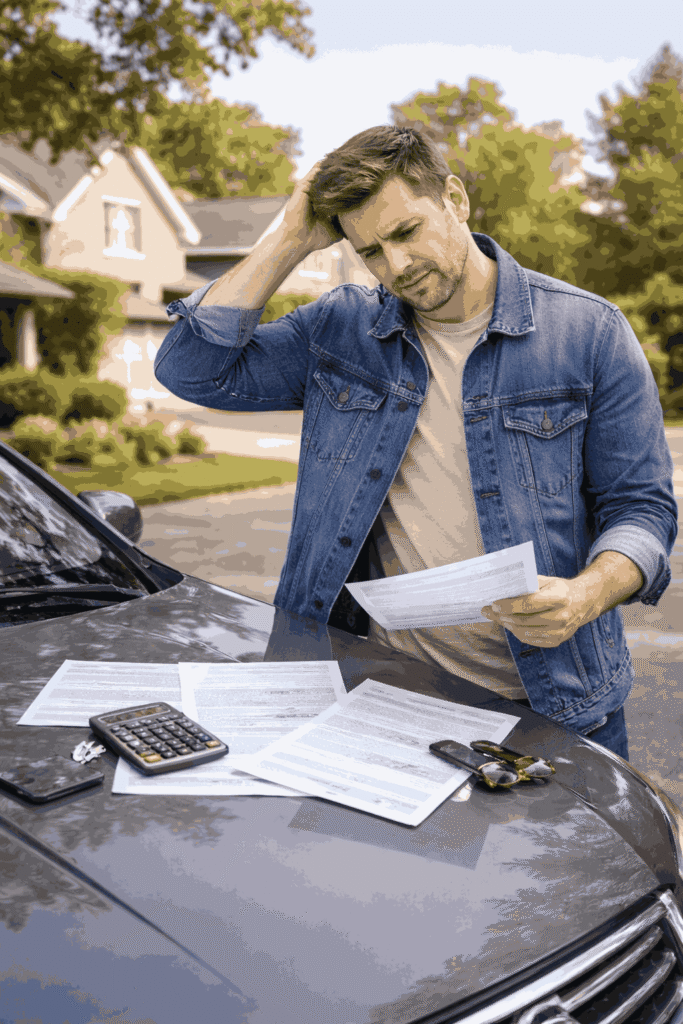

Choosing car insurance in Ontario requires careful consideration and informed decisions. Many drivers unknowingly make costly mistakes that either drain their wallets or leave them vulnerable. Learning about these common errors helps you secure better coverage at competitive rates while avoiding unnecessary headaches down the road.

1. Accepting the First Quote Without Comparison Shopping

Accepting the first quote you receive is one of the costliest mistakes Ontario drivers make. Car insurance providers in Ontario offer significantly different rates for identical coverage. Without comparison shopping, you might overpay by hundreds or even thousands of dollars annually.

Independent brokers have access to multiple insurers simultaneously, presenting you with competitive options. This approach saves considerable time while ensuring you see the best available rates. Even small monthly differences add up to substantial savings over time.

Price variations exist because insurers assess risk differently. One company might offer better rates for young drivers while another favors experienced motorists. Comparing multiple quotes gives you leverage to negotiate and choose wisely.

2. Selecting Inadequate Coverage Limits

Many drivers choose minimum coverage to reduce immediate costs. This decision creates significant financial vulnerability if accidents occur. Ontario law requires Third Party Liability insurance, but legal minimums rarely provide adequate protection in serious incidents.

Insurance experts recommend substantial liability coverage to protect your assets. Severe accidents involving multiple vehicles or serious injuries generate claims that quickly exceed lower limits. When your coverage runs out, you become personally liable for remaining costs, potentially devastating your financial stability.

Our helps you balance comprehensive protection with affordable premiums. Our advisors review your specific circumstances to recommend appropriate coverage levels that protect your assets without unnecessary expense.

3. Overlooking Available Discounts and Savings

Countless drivers pay full premiums while overlooking significant discount opportunities. Bundling home and auto insurance typically saves money on both policies. Winter tire discounts, alumni programs, and professional memberships offer additional reductions that many people never claim.

Common discount categories include:

- Multi-vehicle and multi-policy bundling options

- Winter tire installation discounts

- Good student programs for young drivers

- Defensive driving course completions

- Low mileage or usage-based programs

- Loyalty rewards for long-term customers

4. Choosing the Wrong Deductible Amount

Selecting deductibles requires balancing monthly premiums against potential out-of-pocket expenses. Higher deductibles lower your premiums but increase costs when filing claims. Lower deductibles mean higher monthly payments but reduced financial stress during accidents.

Consider your financial situation realistically. Can you comfortably afford a higher deductible if an accident happens tomorrow? If not, paying slightly higher premiums for lower deductibles provides better peace of mind.

Your driving history matters too. Drivers with clean records might benefit from higher deductibles since they file claims less frequently. Those with recent accidents or tickets might prefer lower deductibles to minimize surprise expenses.

5. Failing to Update Policies After Life Changes

Life circumstances change constantly, but many people forget to update their car insurance accordingly. Moving to a different neighborhood affects your rates. Adding teenage drivers requires coverage adjustments. Purchasing new vehicles demands policy modifications.

Failing to report changes can void your coverage when you need it most. If your insurer discovers unreported modifications or additional drivers after an accident, they might deny your claim entirely. If you recently relocated to the Barrie area, updating your policy becomes even more critical since car insurance in Barrie reflects local factors like weather patterns and traffic conditions.

Contact your broker whenever significant life events occur. Our team makes policy updates simple and ensures your coverage reflects your current situation accurately. Regular reviews catch gaps before they become expensive problems.

6. Skipping Comprehensive Coverage

Collision insurance covers accidents you cause, but comprehensive coverage protects against theft, vandalism, weather damage, and animal strikes. Many drivers skip comprehensive coverage to save money, then face devastating losses from non-collision incidents.

Ontario weather creates unique risks. Hailstorms, flooding, and falling ice damage thousands of vehicles annually. Without comprehensive coverage, you pay repair costs entirely out of pocket. Car insurance services should include discussions about comprehensive protection suited to your region.

Evaluate your vehicle’s value and your financial capacity to absorb losses. Newer or financed vehicles warrant comprehensive coverage. Older vehicles with minimal value might not justify the additional premium expense.

7. Misunderstanding Rental Vehicle Coverage

Your personal auto policy might not fully cover rental vehicles. Many drivers assume their regular insurance extends to rentals without verification. This misconception leads to expensive surprises when accidents occur in borrowed or rented vehicles.

Some credit cards offer rental coverage, but restrictions and limitations apply. Understanding what your existing policies cover before traveling prevents gaps that leave you financially exposed.

Ask your car insurance Barrie broker specifically about rental coverage. Adding rental protection to your policy costs less than purchasing insurance at rental counters repeatedly. Our team reviews your travel habits and recommends appropriate rental coverage options.

8. Neglecting Annual Policy Reviews

Insurance needs evolve as your life changes. Annual policy reviews ensure your coverage keeps pace with your circumstances. You might qualify for new discounts, need coverage adjustments, or find better rates with different providers.

Market conditions shift constantly. Insurers adjust rates, introduce new products, and modify discount programs. Staying informed about car insurance in Ontario market trends helps you maintain optimal coverage at competitive prices.

Schedule annual reviews with your insurance advisor. These conversations take minimal time but potentially save substantial money while ensuring adequate protection. Review after major life events, too, including marriages, divorces, job changes, and home purchases, which all impact insurance needs.

Protect Your Investment With Smart Coverage Decisions

Avoiding these eight common mistakes protects your financial well-being and provides genuine peace of mind. Car insurance in Ontario requires more than simply meeting legal minimums. It demands thoughtful consideration of your unique circumstances and future needs.

Our Team simplifies the car insurance selection process by offering expert guidance and access to multiple providers. Our personalized approach ensures you receive appropriate coverage at competitive rates. Contact us today to start your journey toward better protection and smarter savings.